Insights into Cyber Security Investments

In today’s interconnected world, data breaches affect hundreds of millions of U.S. customers of banks and services yearly. Hacking scandals at major institutions make news because of the headaches they cause for both business stakeholders and their customers, and demand is growing for data protection technologies. To address the challenge of protecting the energy infrastructure from hacking, Paul Borochin, assistant professor in the School of Business at the University of Connecticut, is collaborating with the Eversource Energy Center to develop economic measures of the value of cyber security and to investigate the investment values of the Eversource Energy Resiliency Initiatives in Connecticut.

Investment in cybersecurity is a key to electric grid resilience, security, and economic prosperity. Many options are available for protecting against unauthorized access to data in a system, and third parties sell a variety of both existing and customized products. No clear standard has yet been set, however, for how much customers need to invest in the protection. This is where Professor Borochin’s analysis comes in. By measuring the expected benefit of protections against its cost, a business can invest in just enough cyber security to cover the bulk of its expected risks, thus minimizing the cost that is passed along to customers.

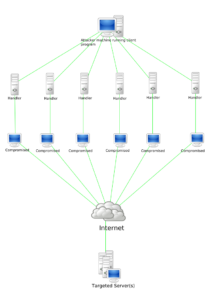

The calculation of risk is the main consideration when determining the expected value of investments made by Eversource Energy, and it involves quantifying the likelihoods of losses and exposures. An essential part of Professor Borochin’s work is mapping areas within the power grid in Connecticut that might be vulnerable to hacking to help Eversource stakeholders design optimal cost–benefit strategies.

According to Professor Borochin, “The challenge we face as economists concerned with capital budgeting is that, while we can attach dollar figures to the benefit of investment, those figures are never going to be completely certain. The point of the techniques we bring to bear, such as the real options framework that models the ability to update investment decisions, is to try to get an estimate specifically in the presence of uncertainty. You end up with a dollar figure, plus or minus some error.” Professor Borochin incorporates this uncertainty when conducting his analysis.

In support of these economic evaluations, Professor Borochin is collaborating with Eversource Energy Center electrical engineers who are creating a software emulation of the Connecticut power grid to test cyber security prevention methods and assess their economic consequences. This research is expected to help protect the Connecticut power grid from cyberattacks originating both at home and abroad.

Paul Borochin received his PhD in finance from the Fuqua School at Duke University and his BS in finance and statistics from the Wharton School at the University of Pennsylvania. Besides cyber security investments, Professor Borochin’s research interests include institutional ownership, applications of asset pricing theory, corporate governance, information asymmetry, and corporate events and policies.

Published: June 21, 2018

Categories: Recent News

Available Archives